BRIEF FROM THE ST. JOHN’S BOARD OF TRADE

Executive Summary

The St. John’s Board of Trade appreciates the opportunity to present its views to the House of Commons Standing Committee on Finance as part of the development of Budget 2012.

The Board’s recommendations to government can be summarized in the following manner:

1. The cost of government has to come down, and a large part of that has to do with the cost of the civil service. Government can reduce staff; if staff cuts are made, government should start at home in Ottawa where the economy is already propped up by government;

2. Considering the relative newness of the P3 Crown Corporation, ensure that it is mandated to have an internal focus as well as an external; that is, don’t just look into communities for infrastructure investments or partnership but also look within government to determine functions that could reasonably be contracted out; and,

3. Keep up infrastructure investments during the downturn but look for more 50 cent dollars or tri-partite arrangements and make sure that there is evidence to justify the investment.

Overall, the Board has been quite clear in its advocacy work that:

· Government has to get back to black and start paying down our crippling debt that leaves $33 billion spent on debt servicing rather than public services and economic development;

· Efficiencies can be introduced into the public service, but decisions have to be made on evidence rather than ideology; and,

· Hard decisions must be taken and respected across the country, but decisions that disproportionately affect or target any one geographical area will not be tolerated.

Introduction

The St. John’s Board of Trade welcomes the Committee’s interest in gathering the views of Canadians on economic recovery, quality sustainable jobs, competitive taxation, and a balanced budget. Our advocacy is clear: adding to debt restricts what we can do today and it ties the hands of future generations. Fiscal management is a quality of life issue - good fiscal management allows government to support social and economic development in Canada. The results of poor fiscal management become very evident - political, social and economic unrest that is being seen in most of the Western world.

It is true that we are „better positioned‟ to weather the storm than other countries because of our debt-to-GDP ratio, but it is equally true that we are not as well positioned prior to 2008-09 because we have since added to our debt. If we are in globally uncertain economic times because of government debt, Canada needs to be a leader in reducing our share of that uncertainty.

Government’s stewardship of public finances is a quality of life issue. Every dollar lost to debt financing is a dollar lost to the community.

Issue #1: Cost of government

This is a simple concept that may get forgotten or overlooked from time to time: people and businesses have to pay for government. Another concept that can get lost is that people and businesses don’t have a choice whether to pay government or not. People and businesses have to trust that government will be effective and efficient stewards of their money, not be treated as a revenue line in a budget.

Government operating expenses for fiscal 2009-10 was $79.3 billion. For fiscal 2006-07, that number was $63.3 billion. Recent national media reports indicate that about 32,000 jobs have been added to the public service since 2006. At the current rate of government re-organization, the federal bureaucracy should be back where it was five years ago by 2064. That means 53 years of continual, incremental job cuts.

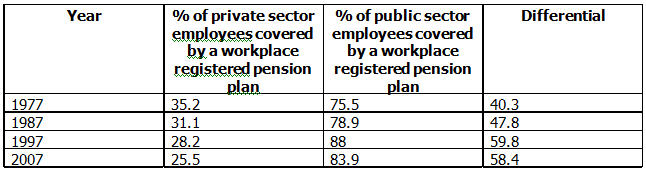

Recently, global markets have been in turmoil. Our members have been expressing their concern about their retirements. Government employees cannot be feeling the same stress, because the unsecured retirements of the private sector are guaranteeing the secured retirements of the public sector.

Perspective on the rate of growth and decline: By 2064, the country will only be three years away from its bi-centennial. Currently, we are still six years away from turning 150.

Source: Statistics Canada

The Board does not believe that private sector companies want to be uncompetitive with employee benefits. The Board believes that private sector companies - who operate in a competitive environment where consumers have choice of whether to support the company or not - recognize that defined benefits programs are economically unsustainable. If it is unsustainable in the private sector, it is unsustainable in the public sector.

Government cannot operate as a business; the Board recognizes that. But it cannot ignore economic principles.

By increasing the cost and size of government adding 32,000 jobs in the past five years and adding $16 billion annually to operating costs in even less time - we are moving further away from a sustainable system.

While the Board recommends that government get its cost structure under control, it would strongly caution government to do it in a reasonable manner. The Board will not stand for being targeted for disproportionate cuts. In the case of job restructuring, government may want to start close to home in Ottawa.

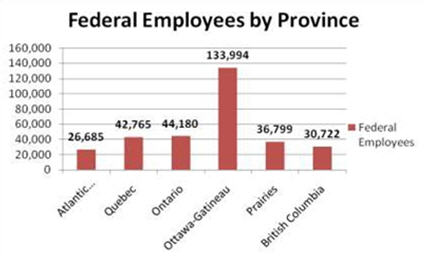

The place to start looking for efficiencies is close to home. Ottawa is already generously supported by government spending and is the centre of its decision-making. It may be easy for a senior bureaucrat in Ottawa, directed to find savings, to cut jobs in „the regions‟ but one job cut in the regions has more impact than one job cut in Ottawa.

The total number of federal government workers in Ottawa-Gatineau in 2010 was 133,994, roughly 40% of the civil service of Canada. This number also accounts for 19.5% of all workers in the Ottawa-Gatineau region, not taking into account indirect jobs created by government’s significant employment and pay footprint in the capital region.

Source: Statistics Canada

Issue #2: Public-Private Partnership

When the upgrading and new infrastructure needs for the provincial/territorial and federal governments are added, the total infrastructure deficit for Canada could easily be between $350 billion and $400 billion. These are real needs to address in the community. But the Board believes that the P3 model can go further.

Government has indicated a willingness to partner with the private sector to build infrastructure, which the Board welcomes. It has clearly signalled this with the creation of a P3 Crown Corporation. Considering the relative newness of this organization, the Board believes that its mandate during its formative years while it is still building policies, practices and procedures not be completely externally focused. That is to say that the Corporation should have a mandate to advise departments and other Crown Corporations on what government programming could more effectively and efficiently be delivered in partnership with the private sector and larger community.

Saeed Mirza, Professor Emeritus of Civil Engineering and Applied Mechanics at McGill University said “Canada’s infrastructure needs are way beyond what can be afforded by all levels of government. Therefore the government must acknowledge that Canada has a serious infrastructure crisis, and they must attempt to find innovative sources of funding, the best being P3s.”

Government should continually look for ways of reaching out rather than assuming all the duties of providing services. The P3 Crown Corporation could use its expertise to help government identify areas where public policy goals of delivering a necessary service, building community capacity, and being responsible stewards of Canadians‟ tax dollars will converge.

Some benefits of P3 that can be applied internally to government are:

· Maximize efficiencies and innovations of private enterprise

· Add capital to government projects/free-up public funds for core government programs Address infrastructure backlog.

P3 is not the answer for all of government’s challenges. But further embracing the concept and providing a greater mandate for examining opportunities within the public sector for alternative delivery models can ensure efficient and effective service delivery because the private sector will have to compete for business and be held accountable for delivering results.

Issue #3: Investments

Considering the global economic picture, the Board understands government’s willingness to invest in the economy to avoid a deeper recession. The Board would advise two things:

1. Where possible, try to find partners to share the one-time costs of infrastructure investments; and,

2. Use evidence in decision-making. Building expensive (construction, operating costs, demographic costs, etc) prisons when the crime rate in the country is decreasing is not an effective use of taxpayer money. Infrastructure is legacy material built for a generation; infrastructure investments for the sake of getting money into the economy rather than those with clear needs will be more expensive in the long run as maintenance costs, the opportunity costs of better projects, and the expectation of more spending come together.

Conclusion

Government has the unenviable task of reining in spending, which cannot be easy. But adding to the costs of government will only make the corrective actions necessary in the future worse. Canada does not have to make severe cuts, but we do have to be careful spenders. At a time when global economies and markets are out of control and domestic consumer confidence is wavering, the only thing we can control is our spending. We have to do that so we avoid the consequences seen around the world.